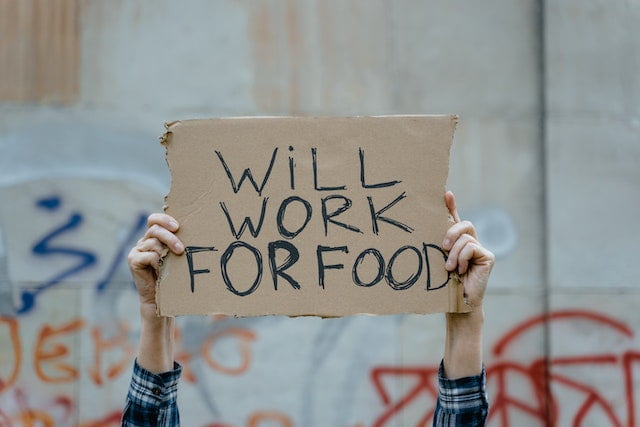

In life, we may find ourselves facing periods when money becomes tight, and financial strain weighs heavily on our minds. However, it is during these challenging times that we have an opportunity to tap into our resilience, creativity, and resourcefulness. With the right mindset and a proactive approach, we can navigate through financial difficulties and emerge stronger than ever before. In this article, we will explore inspirational strategies to save money and discover innovative ways to earn extra income, empowering you to regain control of your finances and build a brighter future.

- Cultivate a Positive Mindset: Facing financial constraints can be disheartening, but adopting a positive mindset is crucial. Believe that you have the power to overcome challenges, and view financial difficulties as opportunities for growth. Stay focused on your goals and maintain a can-do attitude, knowing that your present situation does not define your future.

- Create a Budget: Crafting a budget is the foundation for managing your finances effectively. Evaluate your income and expenses, and prioritize essential needs. Trim discretionary spending and identify areas where you can make meaningful cutbacks. By monitoring your spending habits and adhering to a well-planned budget, you can regain control over your financial situation.

- Embrace Frugality: Frugality is the art of finding joy in simplicity while making the most of your resources. Embrace the principles of conscious spending and seek out cost-effective alternatives. Look for discounts, coupons, and sales, and compare prices before making purchases. Additionally, focus on experiences and relationships rather than material possessions, as true fulfillment often lies in moments shared with loved ones.

- Cut Down on Utilities: Reducing utility bills is an effective way to save money. Practice energy conservation by turning off lights when not in use, unplugging electronics, and adjusting thermostat settings. Consider investing in energy-efficient appliances and light bulbs, as they can significantly reduce long-term costs. Likewise, conserving water, such as taking shorter showers or fixing leaks promptly, can help save both money and the environment.

- Cook at Home and Meal Planning: Eating out frequently can drain your wallet quickly. Embrace the art of cooking at home, as it not only saves money but also enables you to make healthier choices. Plan your meals in advance, create a shopping list, and buy groceries in bulk to minimize expenses. Experiment with budget-friendly recipes and involve your family in the joy of preparing meals together.

- Explore Alternative Transportation: Transportation costs can be a significant burden on your finances. Consider alternative commuting options such as carpooling, biking, or using public transportation. If feasible, walk for short distances and save on fuel expenses. Additionally, regular vehicle maintenance and fuel-efficient driving habits can help you save money on repairs and fuel consumption.

- Boost Your Income: While saving money is crucial, exploring opportunities to increase your income can provide additional financial stability. Consider these ideas below.

- Freelancing: Leverage your skills and expertise by offering freelance services in your field of interest.

- Online Side Hustles: Explore various online platforms that offer opportunities for remote work or part-time gigs.

- Monetize Your Passion: Transform your hobbies or talents into income streams. Start a blog, sell handmade products, or offer personalized services.

- Rent Out Unused Space: If you have a spare room or an unused parking spot, consider renting it out for extra income.

- Take on Odd Jobs: Offer your services for tasks like gardening, pet sitting, or babysitting within your community.

In conclusion, remember that your financial situation does not determine your worth or potential. When money is tight, it’s an opportunity to tap into your inner strength, resourcefulness, and creativity. By adopting a positive mindset, creating a budget, embracing frugality, and exploring alternative ways to save and earn, you can navigate through any financial challenge.

Believe in your ability to overcome obstacles and stay focused on your goals. Every small step you take towards saving money and generating extra income is a victory that brings you closer to financial stability and freedom. Embrace the joy of simplicity, prioritize experiences over possessions, and cherish the relationships that bring true fulfillment.

Keep in mind that this journey is not about deprivation, but rather about making conscious choices that align with your values and long-term aspirations. Celebrate every milestone, no matter how small, and let it fuel your motivation to continue thriving.

So, rise above the limitations of your current circumstances and envision a future where financial abundance is within your reach. With determination, perseverance, and a dash of creativity, you have the power to rewrite your financial story and build a brighter, more prosperous future.

Remember, you are capable, resilient, and destined for greatness. Embrace the journey, learn from the challenges, and let your unwavering spirit guide you towards a life of financial freedom and fulfillment.