Getting out of credit card debt is not just a financial goal; it’s a transformative journey towards reclaiming your financial independence and securing a brighter future. Picture this: a life where every dollar you earn is a step towards your dreams, not a payment towards past expenses. It’s time to embark on a journey of empowerment, where every financial decision you make aligns with your aspirations and leads you closer to the life you envision.

Debt can feel like a heavy burden, especially when it comes to credit card debt with its high-interest rates and seemingly endless cycle of payments. However, getting out of credit card debt is not only possible but achievable with the right mindset and strategies. In this comprehensive guide, we’ll explore actionable steps to help you break free from the shackles of debt and pave the way to financial freedom.

This guide is not just about numbers and strategies; it’s about helping you rewrite your financial story. So, let’s dive in and discover how to turn the tide on credit card debt, step by step, towards a horizon filled with financial freedom and opportunity.

Understanding the Debt Landscape

Before diving into the specifics of getting out of credit card debt, it’s crucial to understand the nature of debt itself. Credit card debt typically accumulates when you use your credit card to make purchases and carry a balance from month to month. The outstanding balance incurs interest, often at rates much higher than other forms of borrowing, making it challenging to pay off quickly.

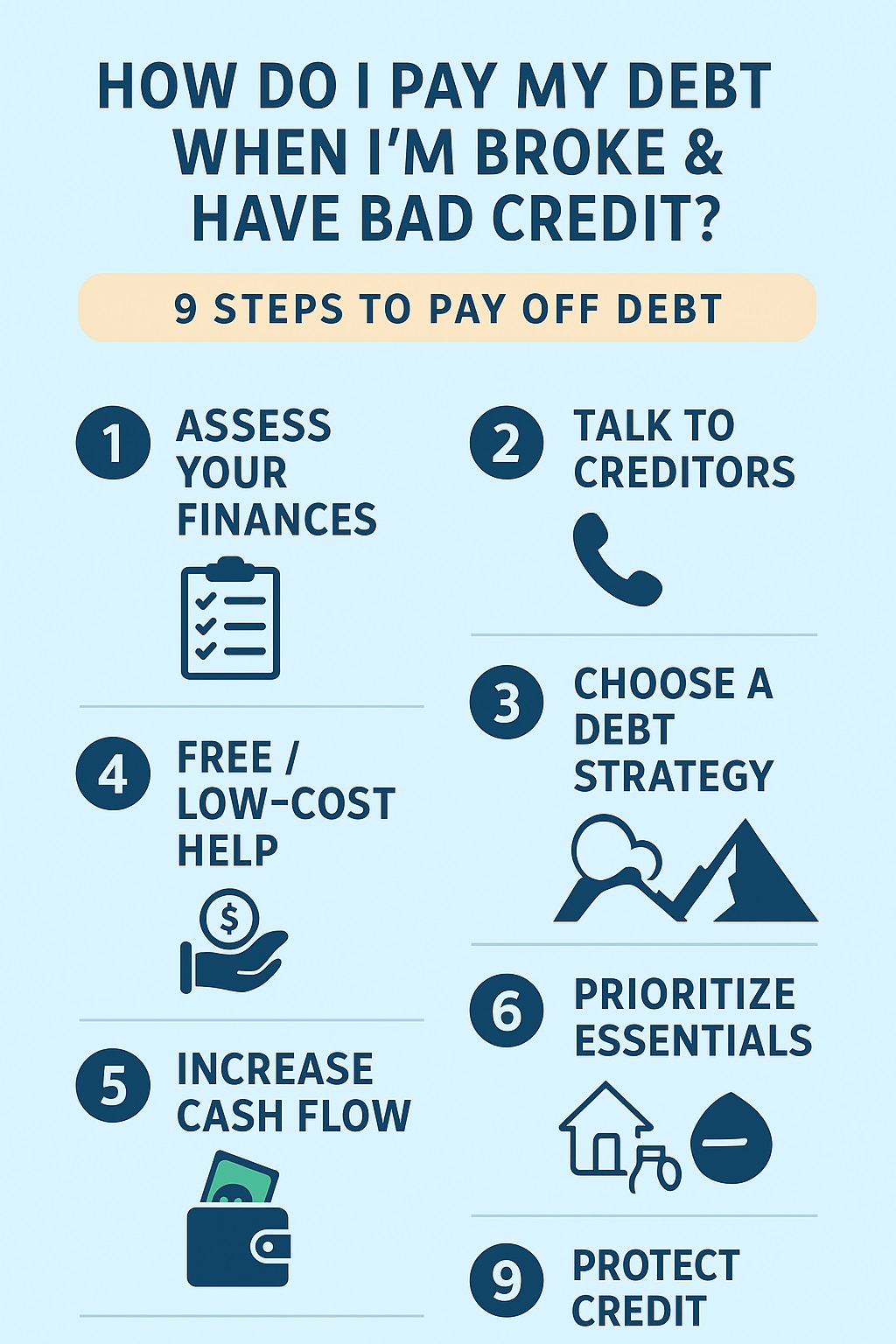

The first step in addressing credit card debt is to assess your current financial situation honestly. This includes gathering all your credit card statements, noting the balances, interest rates, and minimum payments for each card. Creating a clear picture of your debt landscape sets the stage for developing an effective repayment plan.

Building Your Debt Repayment Strategy

- Create a Budget: A budget is the cornerstone of financial stability and debt repayment. Start by listing all your sources of income, including salary, freelance work, or any other earnings. Then, outline your monthly expenses, categorizing them into essentials like housing, utilities, groceries, and discretionary spending like entertainment or dining out.

- Allocate Debt Repayment Funds: Once you have a clear understanding of your income and expenses, allocate a specific portion of your income towards debt repayment. This could be a percentage of your monthly income or a fixed amount dedicated solely to paying off credit card debt.

- Prioritize Debts: Not all debts are created equal, especially when it comes to interest rates. Arrange your credit card debts from highest to lowest interest rates. While continuing to make minimum payments on all your cards, focus on aggressively paying off the debt with the highest interest rate first. This approach, known as the debt avalanche method, minimizes the total interest paid over time.

- Cut Expenses: To free up more money for debt repayment, scrutinize your expenses and identify areas where you can cut back. This might involve reducing discretionary spending, negotiating lower bills for services like cable or internet, or finding creative ways to save on everyday expenses like groceries or transportation.

- Increase Income: Boosting your income can accelerate your debt repayment journey. Consider taking on additional work, whether through part-time jobs, freelance gigs, or selling items you no longer need. Every extra dollar earned can be put towards paying off your credit card debt faster.

- Negotiate with Creditors: Don’t hesitate to reach out to your credit card companies to negotiate better terms. This could involve requesting lower interest rates, waiving late fees, or setting up a structured repayment plan. Many creditors are willing to work with you, especially if you demonstrate a commitment to paying off your debt.

- Consider Debt Consolidation: If you have multiple credit card debts with varying interest rates, consolidating them into a single loan with a lower interest rate can simplify your repayment process. Debt consolidation can be done through balance transfer credit cards, personal loans, or home equity loans, depending on your financial situation and creditworthiness.

- Stay Motivated: Repaying credit card debt is a marathon, not a sprint. It’s essential to stay motivated and focused on your financial goals. Set milestones along the way, such as paying off a specific card or reaching a certain debt balance. Celebrate these achievements to keep your momentum going.

- Avoid Accumulating New Debt: While working towards paying off existing debt, be mindful of your spending habits. Avoid using credit cards for unnecessary purchases and strive to live within your means. Opt for cash or debit cards instead of relying on credit, and resist the temptation to take on new debt.

Practical Tips for Managing Credit Card Debt

In addition to the overarching strategies outlined above, here are some practical tips to help you manage and eventually eliminate credit card debt:

- Track Your Spending: Use budgeting apps or spreadsheets to track your spending habits. Understanding where your money goes can highlight areas for improvement and guide smarter financial decisions.

- Build an Emergency Fund: Having an emergency fund can prevent you from relying on credit cards in unexpected situations. Aim to save enough to cover three to six months’ worth of living expenses.

- Automate Payments: Set up automatic payments for your credit card bills to avoid late fees and penalties. This ensures that you stay on track with your repayment plan.

- Seek Financial Education: Educate yourself about personal finance, budgeting, and debt management. Resources such as books, online courses, or financial advisors can provide valuable insights and guidance.

- Explore Debt Relief Options: If you’re struggling to make payments or facing overwhelming debt, consider exploring debt relief options such as debt settlement, credit counseling, or bankruptcy. These options should be approached with caution and after careful consideration of their long-term impact on your financial health.

Empowering Your Debt-Free Journey: The Power of a Supportive Network

Seeking support is a crucial aspect of navigating the challenging terrain of debt repayment, especially when it comes to credit card debt with its high interest rates and potential financial stress. Here’s an elaboration on why surrounding yourself with a supportive network of friends and family is so essential:

- Emotional Support: Dealing with debt can bring about feelings of anxiety, stress, and even shame. Having a supportive network means having people who understand your struggles, empathize with your situation, and provide emotional support. They can offer a listening ear, words of encouragement, and a sense of camaraderie that reminds you that you’re not alone in this journey.

- Accountability: Your support network can also serve as a source of accountability. When you share your goals and progress with trusted friends or family members, you’re more likely to stay committed to your debt repayment plan. They can check in on your progress, offer gentle reminders, and celebrate milestones with you, keeping you motivated and on track.

- Practical Advice: Friends or family members who have experience with managing finances or overcoming debt can provide valuable practical advice. They may share strategies that worked for them, recommend resources such as budgeting tools or financial literacy workshops, or offer insights into negotiating with creditors or finding additional sources of income.

- Alternative Perspectives: Sometimes, when you’re deep in the midst of debt repayment, it’s easy to become overwhelmed or lose sight of the bigger picture. Your support network can offer alternative perspectives, helping you see challenges as opportunities for growth, setbacks as temporary hurdles, and progress as a testament to your resilience. They can offer fresh ideas, brainstorm solutions with you, and provide a sense of optimism during challenging times.

- Celebrating Successes: Finally, your support network is there to celebrate your successes, no matter how small. Whether it’s paying off a credit card, sticking to your budget for the month, or resisting the urge to splurge on unnecessary purchases, having people who cheer you on and acknowledge your achievements can boost your confidence and reinforce positive financial habits.

Seeking support is not just about having people around you—it’s about building a community of encouragement, accountability, practical guidance, alternative perspectives, and celebration. Together, you and your support network can navigate the ups and downs of debt repayment and move towards a future of financial freedom and stability.

The Road to Financial Freedom

Getting out of credit card debt is not just about numbers; it’s about reclaiming control of your financial future. It requires discipline, perseverance, and a willingness to make necessary changes to your spending and saving habits. By following a structured repayment plan, being proactive in managing your finances, and staying focused on your goals, you can break free from the cycle of debt and pave the way to financial freedom.

Remember, every step you take towards reducing your debt brings you closer to a brighter financial outlook. Stay motivated stay informed, and believe in your ability to achieve a debt-free life. Celebrate your victories, no matter how small, and use them as fuel to propel yourself forward. Keep nurturing your financial health with smart budgeting, responsible spending, and a focus on long-term goals. By staying committed to your financial well-being, you’re not just shaping your own future but also setting a powerful example for those around you.

As you bid farewell to debt’s grip and embrace the freedom of financial independence, remember that your journey doesn’t end here—it’s a continuous path of growth, learning, and prosperity. Cheers to a life filled with possibilities and the confidence that comes from mastering your financial destiny.